“Blue-chip artwork has outperformed the S&P 500 by more than 250% since 2000.”

source investing.com

We offer you the opportunity to acquire artworks directly from established Contemporary artists. Invest in this multi-billion pound industry today.

Our Artists Are Featured In

100%+

Our artists prices have risen by up to

100% over the last 3 years

High growth

Our artists are yet to enter the auction markets, where the most explosive growth is typically seen.

Museum Quality

We allow investors access to Museum quality art at cost price

Why Invest in Art?

- Art has outperformed the S&P 500 by 250% since the year 2000

- We allow everyday investors access to museum-quality art with zero markup

- Art has a tried and tested track record, proved with robust performance in volatile times

- An investment with kudos that you can enjoy, whilst it appreciates in value

What’s Inside The Guide?

- About Elizabeth Xi Bauer and how we can help you build a highly appreciating art collection

- An overview of the art industry

- An introduction to our artists and their available works

- The art purchasing process in detail

- Insights on the art market from industry-leading experts

Get Your Free Guide on Art Investment

Featured Artist

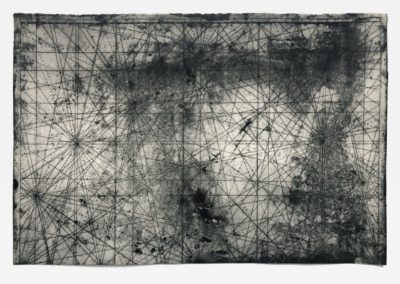

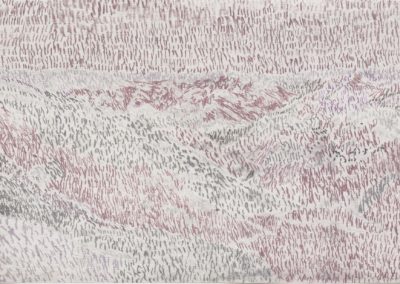

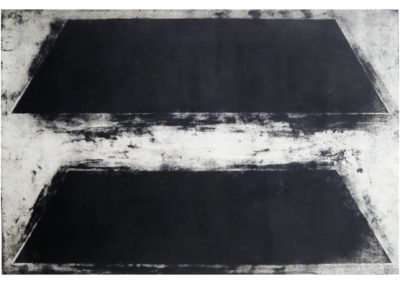

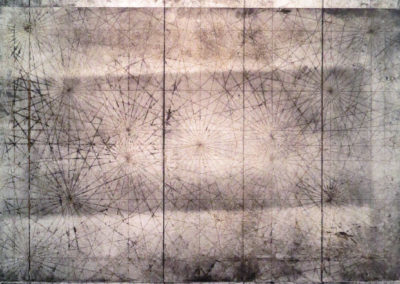

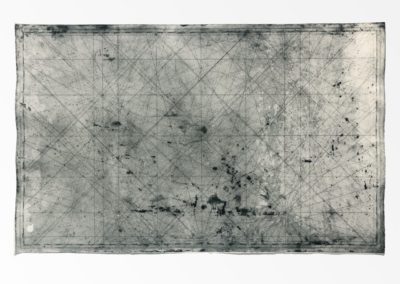

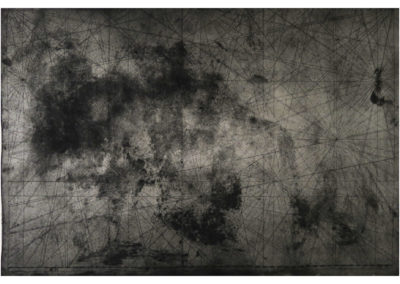

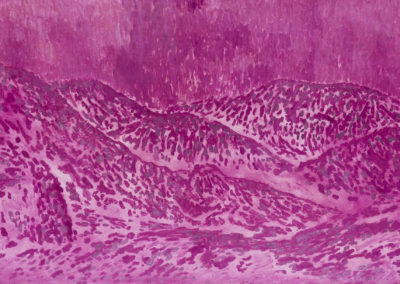

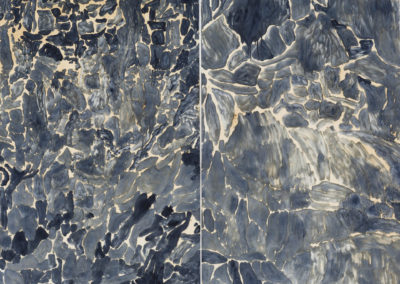

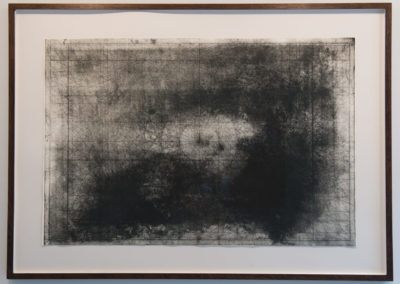

Theodore Ereira-Guyer

Selected Works

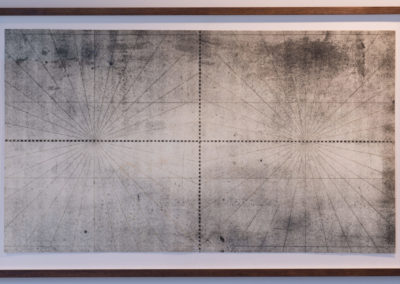

Where bandits hide (forest, mountain, desert)

2016, Steel etching on cotton rag paper, 74×110 cm, edition of 2

The warmth of visibility

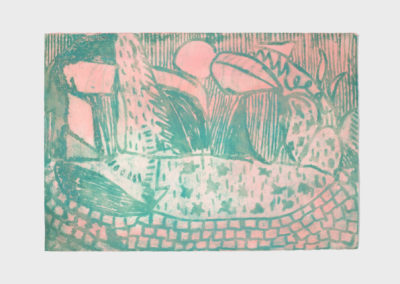

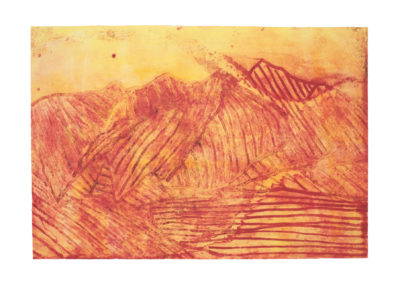

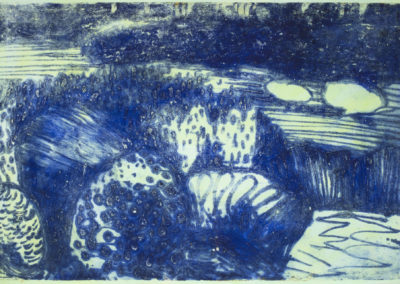

2015, Woodcut on self-insulating blanket, 31×37 cm each, each in an edition of 2

Secondary Market

Who Are Elizabeth Xi Bauer?

We use industry leading media firms to publicise the impressive talents and achievements of our artists to create as much demand as possible. This increase in demand creates market leading capital growth for our collectors.

Callum Welch

Matthew Grochowski

Edward Sheldrick

Artistic Director

Anna Rozkosz

The Process

Consultation

Once you have submitted your details, your dedicated Elizabeth Xi Bauer Art Advisor will provide an art investment consultation to establish your budget, outline your preferences, including your risk appetite, and answer any questions you may have.

Portfolio Management

Your Advisor will prepare a bespoke investment proposal comprised of works that are most likely to achieve your investment goals, keep you up to date with art market news and performance, and inform you of new opportunities that will complement your existing portfolio.

Delivery Or Storage

When you have started building your art portfolio, you can choose whether to have the artwork hung at home or in the office. Alternatively, we can arrange storage with one of our specialist suppliers. We will make the relevant arrangements based on your preferences.

Return on Investment

As you will be the sole owner of artwork(s) purchased, you are welcome to sell the artwork through Elizabeth Xi Bauer’s network of collectors, auction houses, online platforms etc. The most successful art collectors usually adopt a medium to long term approach. Your advisor will be in touch when it is a good time to sell your artwork based on demand for individual artists.

Frequently Asked Questions

What are the risks? Can the value of my art collection reduce and if so, by how much?

So, why art?

Art is not only a tangible investment and an inflation hedge, but by being non-correlating, it can diversify exposure. Furthermore, this non-correlation contributes to the potential for superior returns over a period of time.

Why invest with Elizabeth Xi Bauer (Liz Xi)?

To be clear, you will be buying at the right price, quality and kudos to deliver the safest and most desirable returns possible.

In summary, Elizabeth Xi Bauer mitigates risk by sourcing the correct artists that have achieved a great deal of success to prove that they are worthy of collecting, but, excitingly, they definitely still have the best yet to come!

What do the financial experts say?

Research by J. P. Morgan found that art prices have been less volatile than, and have fluctuated independently from traditional investments such as equities, bonds, commodities and property funds for over 25 years.

“Research has shown that fine art can function as a risk-reducing element in a portfolio because of its low correlation to equities or bonds, while also being a real asset, which provides a hedge against inflation” – Jean-Christophe Gerard, Head of Barclays Private Bank EMEA

88% of wealth managers advise apportioning a part of investment portfolios towards art – Deloitte Art and Finance Report

“For many investors, the market has grown too big to ignore” – Bloomberg

A survey carried out by AXA revealed that private investors consider art to be a more important investment than either government bonds or equities.

So, what drives the market and will it continue?

“The global ultra high net worth individuals’ (UHNWI) population is forecast to rise by 22% over the next 5 years” – The Wealth Report 2019, Knight Frank

So, as the evidence suggests, as long as global wealth creation continues, the demand for art will continue and the art market will continue to be strong.

The most recent Art Basel and UBS Global Art Market Report estimates that global art market sales reached a total of $64.1 billion last year.

In 2014, it was estimated that there were $2 trillion of artworks held in private hands (Anna Dempster, Economist and Senior Lecturer at Sotheby’s Institute of Art). The Economist estimates that $3.6 trillion will be spent on art by 2025.

Do I need to be an expert to succeed in the art market?

It’s true that successful art investment requires extensive know-how and that’s where Elizabeth Xi Bauer comes in. We give you the edge.

We give private investors the exciting and rare opportunity to collect museum-quality artworks only. Every artist and artwork has been stringently validated and verified by our award-winning team of experts.

Substance + Proven Track Record = Serious Potential

Museums are the ultimate art world validation and there is an acute shortage of museum-quality artworks available. Validated museum-quality art is a tangible asset class of deep intrinsic artistic value, low volatility and operates outside of the financial markets (J.P. Morgan) that can also be left to loved ones.

Mayfair

London

W1J 8LQ

VAT number: 355227794

e: contact@lizxib.com