“While the market for blue-chip, tried and tested artists appeared secure, it was the relatively new artists selected for the auctions that experienced most competition from bidders. With record prices reaching 10 times the estimates seen frequently, auction houses are setting new price points for artists who have primarily been experiencing primary-market success”

We offer you the opportunity to acquire artworks directly from established Contemporary artists. Invest in this multi-billion pound industry today.

While the market for blue-chip, tried and tested artists appeared secure, it was the relatively new artists selected for the auctions that experienced most competition from bidders. With record prices reaching 10 times the estimates seen frequently, auction houses are setting new price points for artists who have primarily been experiencing primary-market success

Our Artists Are Featured In

100%+

Our artists prices have risen by up to 100% over the last 3 years

High growth

Our artists are yet to enter the auction markets, where the most explosive growth is typically seen.

Museum Quality

We allow investors access to Museum quality art at cost price

Why Invest in Art?

- Art has outperformed the S&P 500 by 250% since the year 2000

- We allow everyday investors access to museum-quality art with zero markup

- Art has a tried and tested track record, proved with robust performance in volatile times

- An investment with kudos that you can enjoy, whilst it appreciates in value

What’s Inside The Guide?

- About Elizabeth Xi Bauer and how we can help you build a highly appreciating art collection

- An overview of the art industry

- An introduction to our artists and their available works

- The art purchasing process in detail

- Insights on the art market from industry-leading experts

Get Your Free Guide on Art Investment

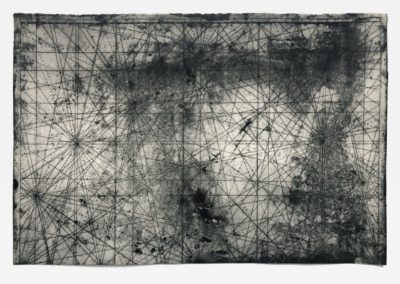

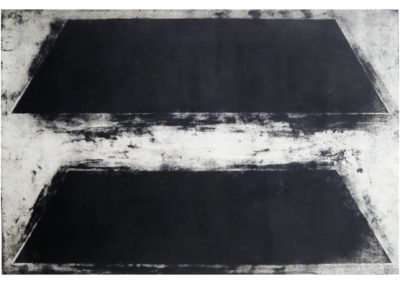

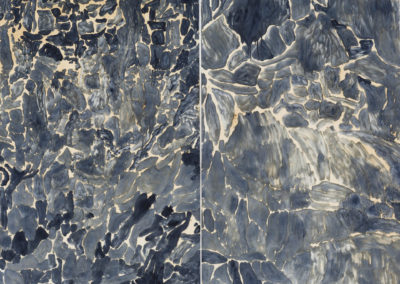

Featured Artist

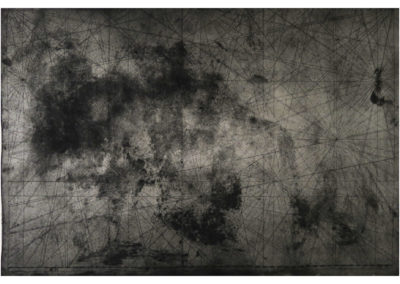

Theodore Ereira-Guyer

Selected Works

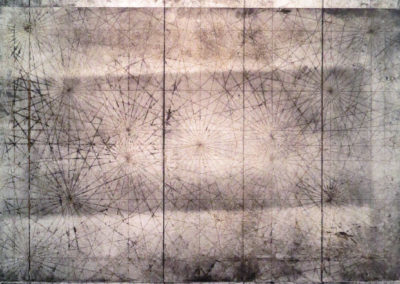

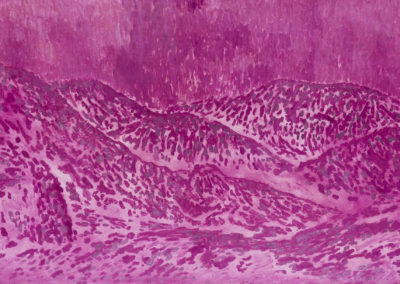

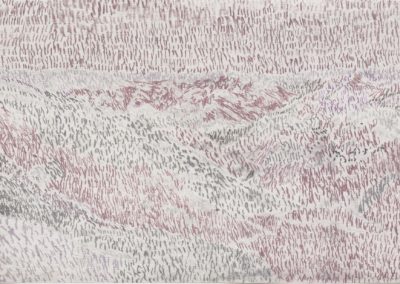

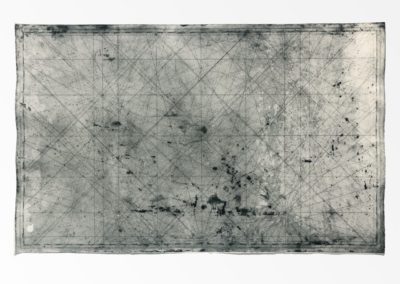

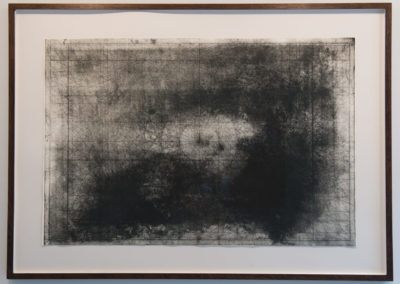

Where bandits hide (forest, mountain, desert)

2016, Steel etching on cotton rag paper, 74×110 cm, edition of 2

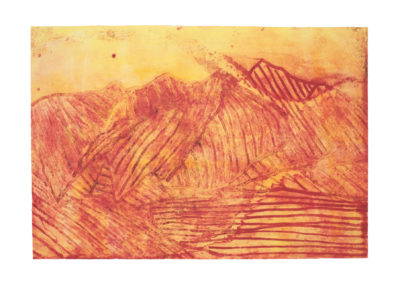

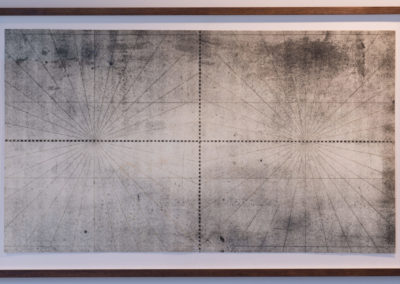

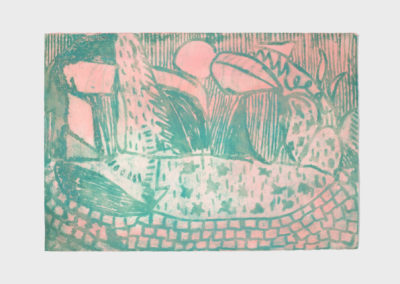

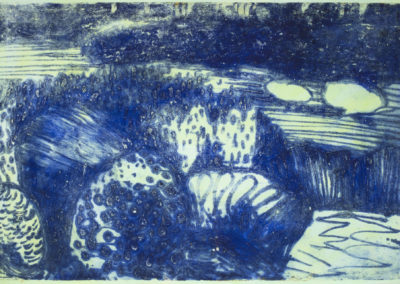

The warmth of visibility

2015, Woodcut on self-insulating blanket, 31×37 cm each, each in an edition of 2

Secondary Market

Who Are Elizabeth Xi Bauer?

Callum Welch

Matthew Grochowski

Edward Sheldrick

Artistic Director

Anna Rozkosz

The Process

Consultation

Once you have submitted your details, your dedicated Elizabeth Xi Bauer Art Advisor will provide an art investment consultation to establish your budget, outline your preferences, including your risk appetite, and answer any questions you may have.

Portfolio Management

Your Advisor will prepare a bespoke investment proposal comprised of works that are most likely to achieve your investment goals, keep you up to date with art market news and performance, and inform you of new opportunities that will complement your existing portfolio.

Delivery Or Storage

When you have started building your art portfolio, you can choose whether to have the artwork hung at home or in the office. Alternatively, we can arrange storage with one of our specialist suppliers. We will make the relevant arrangements based on your preferences.

Return on Investment

As you will be the sole owner of artwork(s) purchased, you are welcome to sell the artwork through Elizabeth Xi Bauer’s network of collectors, auction houses, online platforms etc. The most successful art collectors usually adopt a medium to long term approach. Your advisor will be in touch when it is a good time to sell your artwork based on demand for individual artists.

Frequently Asked Questions

What are the risks? Can the value of my art collection reduce and if so, by how much?

So, why art?

Why invest with Elizabeth Xi Bauer (Liz Xi)?

What do the financial experts say?

So, what drives the market and will it continue?

Do I need to be an expert to succeed in the art market?